Introduction:

The greatest test that FinTech business industry is pulling off is attracting and holding on to customers. Fortunately, wearable application development services are trend setting innovations that can practically transform any weakness into a business quality. This is the situation with wearable innovations and FinTech. Wearables in the finance division assist partners with learning client inclinations, interest clients with new administrations and providing unmatched experiences is of utmost priority for businesses.

The eventual fate of wearables in FinTech depends for the most part on the development of the Internet of Things in this industry. Businesses are on the look out for wearable device developers as that is the ultimate user experience that any business can provide to the customers. How about we see how wearable devices and IoT innovation helps FinTech players stand out.

Opportunities for Wearable technology and FinTech

Wearable gadgets associated with different devices broaden the abilities of the connected devices. An ongoing report by Ericsson ConsumerLab shows that 74% of respondents accept different wearables and sensors will assist them with cooperating with different gadgets and physical things around them. A similar overview proposes that by 2020, cell phone clients will be prepared to wear a minimum of five wearable gadgets.

The Internet of Things or IoT is by and large quickly executed in an assortment of enterprises, including FinTech. The different advantages of using IoT innovation, incudes that fact that itcan tackle one of the most serious issues in the FinTech business, bringing in more clients and holding onto them. This is when wearable tech can be of assistance as FinTech organizations can take an immense step forward. With wearables and IoT innovation, players in the financial sector can comprehend client inclinations, offer new administrations to them, and provide superb experiences.

How Do IoT and Wearables Affect Businesses?

From wearables to smart homes and connected devices, IoT is everywhere. IoT gadgets continue to grow in numbers, so businesses crucially need to consider it. According to Gartner, 14.2 billion connected devices are expected to be in use by the end of this year 2019 and 25 billion tools by 2021.

IoT influencing businesses

IoT gadgets (including wearables), IoT software, and sensors are multiplying at a rapid speed.

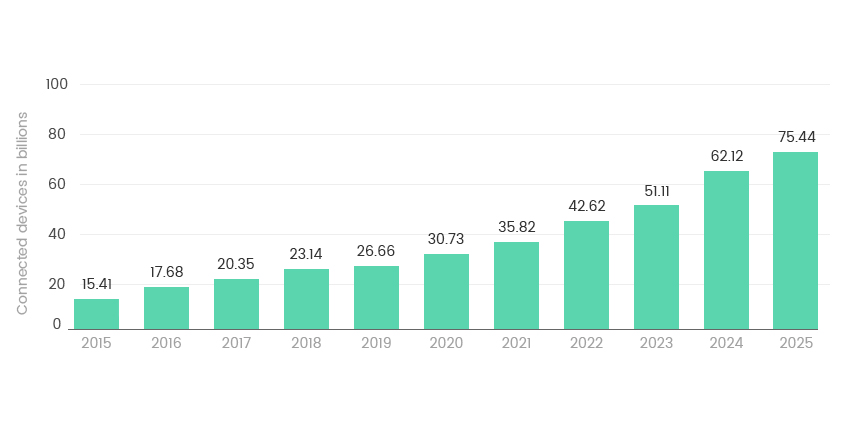

Overview of IoT installed devices worldwide from 2015 to 2025 (in billions)

Source: Statista

Many industries are now paying significant attention to this tech. FinTech is one of the industries that can greatly benefit from IoT possibilities. A business that implements this technology has the potential to provide its customers with new experiences, save on costs, improve the efficiency of processes and build additional revenue models. Around 94% of businesses that have already invested money in IoT services said they had received a good ROI percentage, and it is just the beginning. With time, all businesses will have to adopt IoT to stay competitive in the market.

What Opportunities Do Wearables Create in the FinTech Sector?

As wearables become progressively well known, the abilities of IoT for organizations become increasingly evident. Wearables are, truth be told, picking up prevalence over cell phones. As per a buyer study by Ericsson, 43% of met said that they accept wearable contraptions will supplant cell phones. Moreover, wearables in FinTech can help entrepreneurs to think of new administrations and answers for basic difficulties.

Here are the particular ways the wearables market can be of help for the FinTech business:

1.Wearables in banking can give access to an abundance of data:

As wearables are with clients all over the place, they are superb wellsprings of client bits of knowledge. Also, FinTech can profit widely from this data. Cisco evaluated that IoT would create in excess of 500 zettabytes of information consistently from 2019. FinTech, being more innovation smart than conventional monetary organizations, can utilize client information to convey smooth and safe exchanges for their demographic.

2. Wearables in FinTech can assist organizations with accomplishing client driven destination:

Wearable innovation and FinTech can result in streamlined customer bank associations. Fintech organizations can use client information to anticipate their conduct progressively and target them with customized offers at the ideal time.

3. FinTech organizations can offer wearable instalments

Despite the fact that charge/Mastercards are the most famous techniques for installment with respect to now, the circumstance may move as a result of wearable innovation and FinTech tasks in the coming years. These days, there are numerous organizations keen on contactless installments. Before long, clients will make basic motions like tapping their savvy groups or watches to make installments. In numerous pieces of the world, paying through wearables has become a prevalent versatile installment strategy. Instances of organizations testing out this kind of installment incorporate the Netherland’s ABN AMRO Bank and Australia’s Bankwest.

4. IoT and wearables can give a consistent omnichannel client experience:

With hardened challenge in budgetary administrations, FinTech and advanced money related suppliers are pushing the limits of developments to contend with customary banks. By joining IoT innovation and wearables to make propelled administrations, Fintech suppliers offer a consistent encounter to clients and outmaneuver contenders. A portion of these inventive arrangements we would already be able to see today incorporate ATM pulls back utilizing smartwatches, verification through biometric data, and so on.

5. Wearables and IoT can elevate risk assessment:

About 5.5 million gadgets are being added to the IoT consistently. With these numbers, combined with the monstrous measures of information that wearable gadgets give, such establishments as banks, FinTech firms, and insurance agencies can evaluate dangers better. For instance, P2P moneylenders might have the option to find increasingly about an individual before they continue with giving an advance.

6. The equivalent goes for protection firms, choosing whether to give protection or not:

Wearables can give point by point data about the individual’s degree of obligation, spending limit, past bank transactions, unsafe driving conduct, physical training etc.

Conclusion

After knowing the capability of IoT and wearables, Fintech organizations that stay aware of the creative methodologies in tech will have a higher situation to different organizations in the financial sector.

The Internet of Things and wearable devices can make contributions according to client behaviour and purchasing power, improve customer care services by providing a better experience and introducing simple, secure instalments.